Digital Banking Channels

Digital Products and Services for the banking integration solutions, mobile banking apps, fintech banking software, banking CRM software and gateways.

Delivers, Maintains, Supports for Alternative Delivery Channels to improve banking business.

Digital Banking Channels

Digital Products and Services for the banking integration solutions, mobile banking apps, fintech banking software, banking CRM software and gateways.

Delivers, Maintains, Supports for Alternative Delivery Channels to improve banking business.

Shift to Offering Online & Digital Services

Digital banking involves high levels of process automation and web-based services and may include APIs enabling cross-institutional service composition to deliver banking products and provide transactions. It provides the ability for users to access financial data through desktop, mobile and ATM services.

Internet and Mobile Banking

Internet and Mobile Banking  Digital Wallet

Digital Wallet  Unified Payment System

Unified Payment System  Core Banking

Core Banking  Finance Planning

Finance Planning  Remittance Service

Remittance Service  Point Of Sales

Point Of Sales  Card Systems

Card Systems  Payment Gateways

Payment Gateways Talk to our Expert

“Visible Stars has empowered banking and finance with Information Technology to get good moving for the resources and project.”

Mohamed Al Mutairi

Department Manager, Customer Experience Metrics and Insights

Digital Transformation Strategies

Accelerate your innovation and ideas with the Digital Leader towards Digitalized Systems.

A digital banking is a smart, adaptable, innovative organisation that can compete in the digital economy. Digital businesses reinvent rather than enhance or improve whatever is already in existence. They look at the world through virtual reality goggles, see new possibilities and are geared up to making things happen without causing a world of pain.

- Provide dealers with up-to-the minute app notifications and insights to manage experiences and immediately close the loop with customers

- Help dealerships stay one-step ahead in managing reputation with social media insights into how customers feel about local competitors

- Enhance cross-sell and retention efforts by making key mileage moments special. 360-customer-profiles enable teams to personally engage owners at scale

Infographic

Visible Stars for IT, Finance and Banking Industry

Learn how Visible Stars helps in Digitization of Products and Services.

Digital Services with us!

Worldwide, business leaders face market and investor pressure to optimize operational performance at an accelerating pace and larger scale.

Enhancements & Services on:

Online Banking Channels

Core Banking Solutions

Loan Software Solutions

Banking Big Data solutions

Critical Bug Fixes on Digital Systems

It’s good to check basic tools for the banking industry: administration, databases, data import, hosting, security, and support for both the front and back-office systems. Apart from traditional IT-related services, banks can outsource stuff that is moving to digital ecosystems, as well.

- Digital transformations. Banks actively migrate to the digital universe where they can meet new customers’ demands. IT companies serve as partners as they create and support online/digital versions of mailing campaigns, accounting tools, reports, HR management platforms, ETL processes and so on.

- Omnichannel solutions. Modern customers require more personalized and streamlined access to banks’ services. IT outsourcing companies can handle the migration to omnichannel platforms that provide for easy access from any device. Simultaneously, such platforms facilitate real-time data collection and its analysis, so financial institutions can improve customers’ experience.

- Blockchain technology. Innovations rapidly change industries and blockchain technology highly relates to the financial sector. While banks may face difficulties with decentralized platforms, experienced IT teams are ready to implement them. Thanks to blockchain-based storages and networks, your company can deliver and protect data much more efficiently.

- CRM. Banks rely on their customers’ loyalty a lot. This means that specific systems for attracting, retaining, and pleasing clients are vital for any bank that wants to grow. CRM platforms are considered as totally in-house tools because they keep sensitive information.

- BI and analytics. To deliver perfect services, financial companies have to study clients and learn their wishes. Business intelligence and analytical departments gather big data, create comprehensive reports and suggest changes.

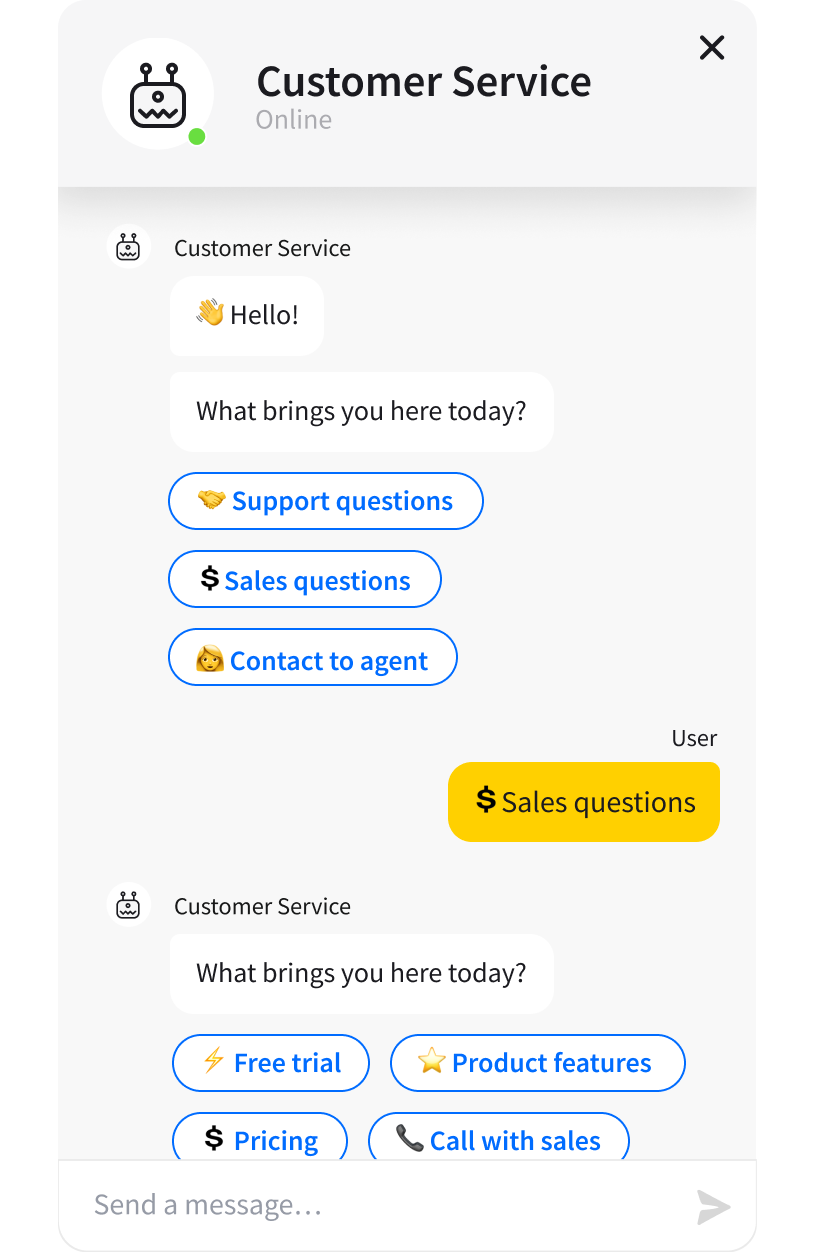

Chatbot - Artifical Intelligence

A chatbot is software that simulates human-like conversations with users via text messages on chat. Its key task is to help users by providing answers to their questions.

Dig deeper into our 2021 Chatbot Guide and learn what makes chatbots valuable for businesses.

It’s good to check basic tools for the banking industry: administration, databases, data import, hosting, security, and support for both the front and back-office systems. Apart from traditional IT-related services, banks can outsource stuff that is moving to digital ecosystems, as well.

- DigitalCX is now Conversational AI Cloud: Conversational AI Cloud is your go-to solution to automate conversations. Engage with your customers in a personalized way via virtual assistants, intelligent chatbots, and Conversational Artificial Intelligence.

- With ChatBot, automating customer service is a breeze - Improve at every stage of your business growth. No matter whether you’re a growing company or a market leader, ChatBot helps you communicate better with customers and push your business forward.

- Nurture: Lead customers to a sale through recommended purchases and tailored offerings.

- Qualify: Generate and qualify prospects automatically. Transfer high-intent leads to your sales reps in real time to shorten the sales cycle.

- Convert: Let customers purchase, order, or schedule meetings easily using a smart chatbot.

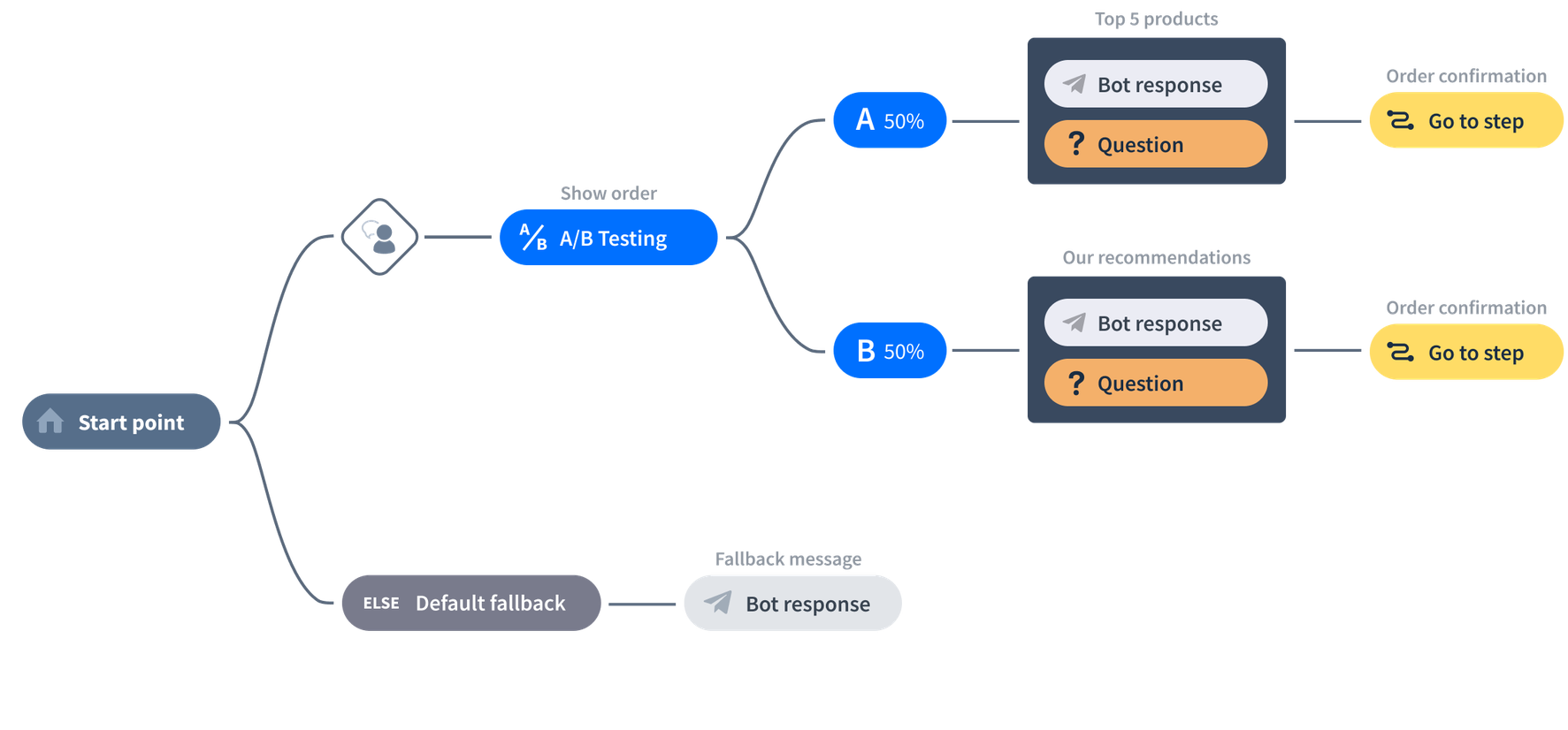

- Build, Test, and Refine: ChatBot's Visual Builder empowers you to create perfect AI chatbots quickly and with no coding. Drag and drop conversational elements, and test them in real time to design engaging chatbot Stories.

- Integrate ChatBot software with tools for marketing, analytics and growth that you’re already using. Streamline repetitive tasks to gain more time to focus on things that matter.

Text Chat Intelligence

Text Chat Intelligence  Voice Call Support

Voice Call Support  Banking, Finance and FinTech

Banking, Finance and FinTech  All in One Chatbot Platform

All in One Chatbot Platform  Multiple Language Support

Multiple Language Support  Smart bot for Automation

Smart bot for Automation

Infographic

Banking - Internet Of Things

In the digital space of finance and banking operations, mobile applications and net-banking are streamlining operational costs, but also bringing customer service into the limelight. To be able to provide seamless support to consumers, at the time and channel of their convenience, its important to choose an outsourcing partner that understands and builds solutions for your business needs.